ACOM is the Philippines finance department that provides cash loans to people or businesses. ACOM Cebu mainly offers a variety of loans to fulfill the customer’s needs. Moreover, along with the technological world, you can pay Acom loans via GCash, which is the leading platform for online payments. If you want to know How To Pay An ACOM Loan Using GCash, we have discussed it here.

Quick Overview on How To Pay An ACOM Loan Using GCash:

Step 1: Enter MPIN

Step 2: Determine GCash Wallet Amount

Step 3: Find The Bill Icon

Step 4: Select Loans

Step 5: Enter Payment Details

Step 6: Recheck And Submit

Step 7: Payment Successful

The company provides short, long, and mid-term base loans with competitive rates and repayment flexibility. With its strong customer service reputation and transparent process, it has become the leading cash loan provider in the city.

Here is Table of content for the article How To Pay An ACOM Loan Using GCash.

In this article, we have mentioned what ACOM is and whether it is legal or not. How to use GCash to pay ACOM loans? Apart from it, many platforms allow paying the ACOM, but GCash is our priority. Without further ado, let’s get to the topic!

What is ACOM Philippines?

ACOM is a large and widely known finance institution in the Philippines that became the first-ever corporation to introduce an automated loan application system.

Nowadays, the company holds a significant partnership with Mastercard International. It has the majority of the ACOM shares, about 40%.

A step-by-step guide On How To Pay An ACOM Loan Using GCash

The step-by-step guide On How To Pay An ACOM Loan Using GCash is listed in the following section:

Step 1: enter MPIN:

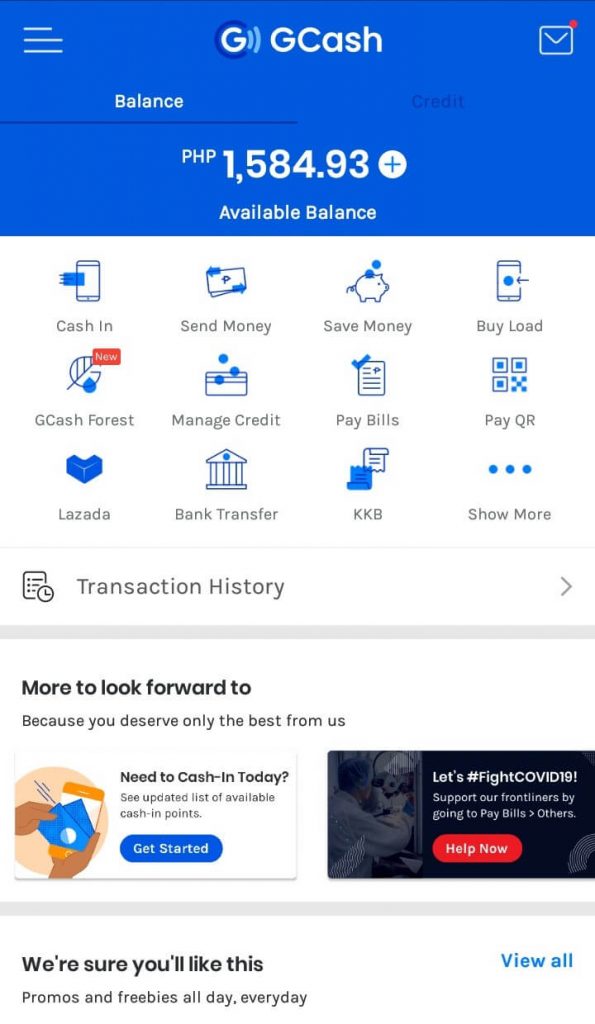

Once you open the GCash app, it demands a 4-digit MPIN; enter the pin code.

Step 2: determine GCash wallet amount:

Ensure the amount is in the GCash wallet, which must’ve enough to pay the bill. Then tap on the Pay Bills icon.

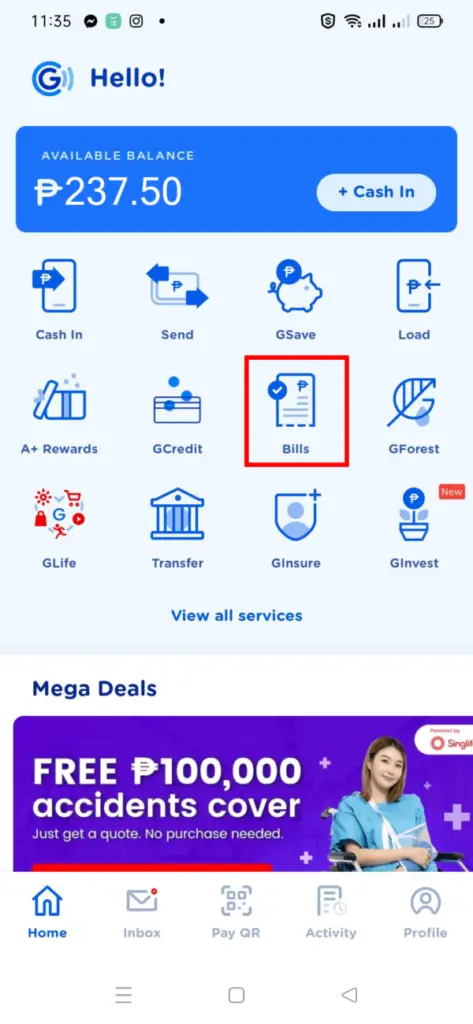

Step 3: Find the Bill icon:

Look for the bill option. It will display the list of all the possible options under bill payment.

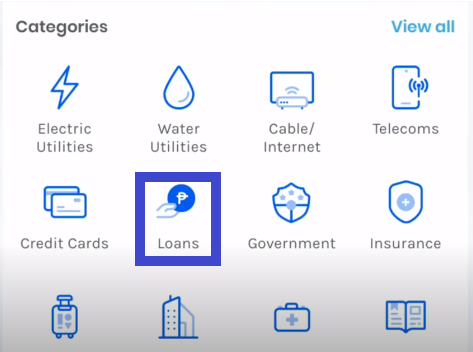

Step 4: Select loans:

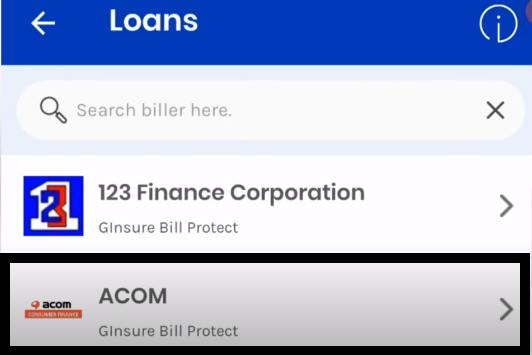

Look for loans. You can mark the selected option or scroll down to find ACOM. You can also search for it from the search bar.

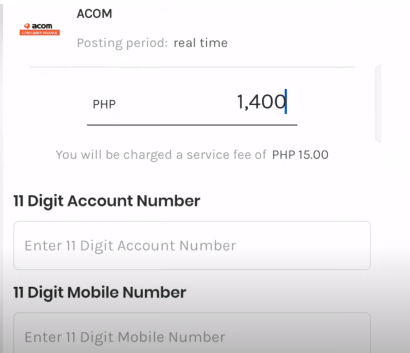

Step 5: Enter payment details:

As you click on ACOM, it will move you to the page where you need to provide the payment details. It demands setting the posting period to real-time so it can be paid without delay. Just enter the 11-digit account number, an 11-digit mobile number the optional email address. Type the money you need to pay, and you may also charge extra charges of about 15 Php. Agree to the terms and conditions and tap on the Next button.

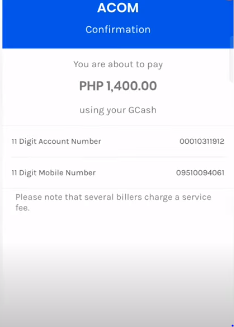

Step 6: Recheck and submit; payment successful:

Double-check the payment detail. You can also add an email so the confirmation message goes to your email address. When you are sure that entered information is correct, Click “NEXT.” And you are done! You can also get the notification on the app screen for Payment. It will determine that the Payment is successful. Save the recipient on your mobile phone as proof.

Is it safe to pay the ACOM loan?

In the Philippines, the finance company that wishes to work must get permission from the law. SEC (Securities and Exchange Commission) is the one that offers permits on an official webpage website sec.gov.ph, and you can get the list of trusted companies.

ACOM company is one of the registers on a website list, which means it works in the country under the law and has passed the requirements demanded by a supervisory.

If you are worried whether the company is legal or not, then rest assure it is operating by law. In the Philippines, it is registered and certified, and the ACOM app is also legal, so install it on your mobile phone with no worries. The advantages of using the ACOM Loan are described in the following:

- The application process is simple; to apply, the customer needs to fill in the short form.

- Instant loan approval. After the application submission, with in a day, an ACOM representative will contact the consumer and inform them about the loan approval decisions.

- Receive cash instantly, and the consumer can withdraw the funds from any branch of the Aom partner.

- Good opportunity for loan repayment, and to close it, the customer can apply to any ACOM-associated branch.

Conclusion:

In above article you understood How To Pay An ACOM Loan Using GCash. GCash is the app through which you can transfer money and pay the ACOM loan. ACOM is the leading organization that offers loans to its clients and integrates with the GCash app to make loan payments easy. The step-by-step guide to paying ACOM loans through GCash is described above in this article. You must read it thoroughly for proper understanding.

FAQs | How To Pay An ACOM Loan Using GCash

Q: What Is ACOM, And How To Pay An ACOM Loan Using GCash?

Ans: ACOM is a large and widely known finance institution in the Philippines that became the first-ever corporation to introduce an automated loan application system. You can pay the loan using GCash by following the steps:

Click Bills

1. Tap Loans

2. Select ACOM

3. Type 11-Digit Membership No.

4. Enter ACOM Registered Mobile No.

5. Type Amount

6. Provide an Email Address

Q: Is It Safe And Secure To Pay My ACOM loan using GCash?

Ans: ACOM company is one of the registers on a website list, which means it is working in the country under law, and passed the requirements demanded by a supervisory. If you are worried about whether a company is legal or not, then rest assure it is operating by law.

Q: What Are The Steps To Pay ACOM loan Using GCash?

Ans: The steps the pay my ACOM loan using GCash are as follows:

1. Click Bills

2. Tap Loans

3. Select ACOM

4. Type 11-Digit Membership No.

5. Enter ACOM Registered Mobile No.

6. Type Amount

7. Provide an E-mail Address.

Q: How Do I Know If My Payment For My ACOM loan Through GCash Was Successful?

Ans: After the payment on GCash, you will get a notification for confirmation on your registered mobile number that determines that the ACOM loan through GCash is successful.

Q: What Are The Charges For Paying My ACOM loan Through GCash?

Ans: When you pay the ACOM bill using GCash, apart from the payment, you will charge additional charges for about 15 Php.

Q: Can I Pay My ACOM loan Using GCash Even If I Don’t Have Enough Balance In My GCash Wallet?

Ans: No, you cannot pay the ACOM loan using GCash even if I don’t have enough balance in my GCash wallet. So, make sure to have a sufficient balance before making any payment.

Q: What Should I Do If I Encounter An Error Or Issue When Paying My ACOM loan Through GCash?

Ans: if you encounter an error or issue when paying your ACOM loan through GCash, contact the 24/7 GCash customer service and ask them about your issue.

I’m Miguel Reyes, your trusted GCash expert here at Money Tech Guide. As a proud Filipino, I’m thrilled to share my extensive knowledge and firsthand experiences with GCash, the revolutionary digital payment platform that has transformed the way we handle our finances in the Philippines.