Nowadays, it is widespread to make online payments for many things. If you want to know the payment method of How To Pay BIR Thru GCash, here you will get all the answers to your questions. Gcash is a very beneficial application as you can pay for bills, taxes, mobile loads, online shopping, etc. This application provides a straightforward and quick method to perform many online tasks.

Quick Overview on How To Pay BIR Thru GCash:

Step1: Log Into GCash

Step2: Select Biller Category

Step3: Choose BIR

Step4: Select Your Form Series

Step5: Enter Your Return Period

Step6: Input Your TIN

Step7: Enter Your Branch Code

Step8: Write Your Amount

Step9: Enter Your Email Address

Step10: Tap Next And Confirm

Step11: Wait For The SMS

The Bureau of International Revenue (BIR) is the management that collects all the national or international credits, allowances, and payments and also carries out the confiscations, retribution, and charges of the inhabitants of the Philippines. To give a better life to Filipinos, this agency rules all the funds, assessments, and rules and regulations of the country.

In this article, I will discuss the importance of GCash and BIR; How To Pay BIR Thru GCash? How to pay BIR annual registration fee using GCash? The payment methods of BIR, the GCash BIR payment return period, and the BIR branch codes list. Stay tuned till the end to gather all this information. Let’s begin the blog!

Importance of BIR:

As the citizens of the Philippines must get verified and registered to BIR, here are some points about the importance of BIR mentioned in the following section below:

- You can only start your own business if you are registered through BIR.

- If you are earning from any source and not paying taxes to BIR, you can be fined on arrested legally.

- When a businessman gets registered with BIR, he can get loans and financial encouragement from the Government.

Importance of GCash:

Filipinos love using GCash because it is a very accessible, convenient, and easy mobile application. As with this application, your mobile phone turns into a wallet, and having money on your phone is very satisfying and relaxing. In another way, it is very safe to carry a large amount of money, and taking care of it isn’t easy sometimes, but when it is safe in your smartphone, it looks pretty convenient to carry and spend wherever and whenever you want.

Moreover, you can manage everything through one application, and there is no more need to use credit or debit cards. GCash is now connected with many banks, companies, online stores, etc. So you can easily make payments and make any transactions quickly. GCash is very safe and secures as it takes care of your money and guarantees your private information’s security.

List of codes of BIR:

Some principal BIR branch codes are mentioned in the section below:

- 005 Alaminos, Pangasinan.

- 077 Bacolod City.

- 008 Baguio City.

- 020 Balanga, Bataan.

- 002 Baler, Aurora.

- 007 Bangued, Abra.

- 058 Batangas City.

- 014 Bayombong. Nueva Vizcaya.

Step-by-step guide on How To Pay BIR Thru GCash

You can quickly on How To Pay BIR Thru GCash by following these customized steps, which are mentioned in the following section below:

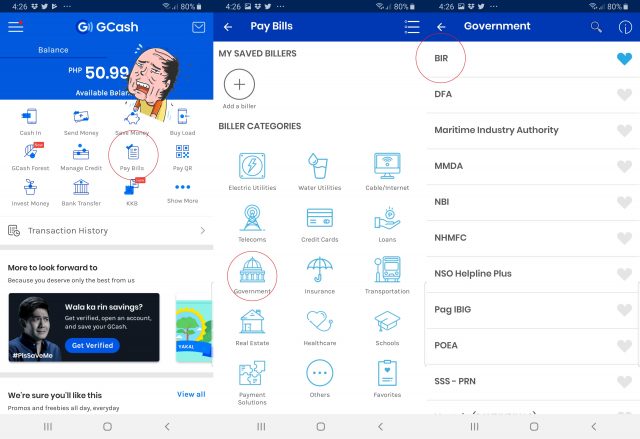

Step 1: Log into GCash

First, you must install the GCash application through the play store and log into your GCash account.

Step 2: Select Biller Category

On the homepage of the GCash application, several icons will appear. You have to tap on the icon government.

Step 3: Choose BIR

In this step, your biller category (Government) will include several options you have to choose as per your need; as you are going to pay for BIR, you will tap on the option BIR.

Step 4: Select your Form series

From the given options, you have to click on form series and enter the series number and scroll down.

Step 5: Enter your return period

In this option, you must click on return period and enter the date, month, and year you will return the amount.

Step 6: Input your TIN

In this step, you have to fill in the 9-digit code given to you on your statement.

Step 7: Enter your Branch code

After filling in the TIN number, you must enter your branch code, which is present with your TIN. The last 3 digits of the TIN are your branch code.

Step 8: Write your amount

In this step, you must enter the amount you must pay for your BIR taxes or BIR 0605 annual registration.

Step 9: Enter your email address

You have to fill in the required details that GCash wants from you, including your email address, contact number, account number, etc.

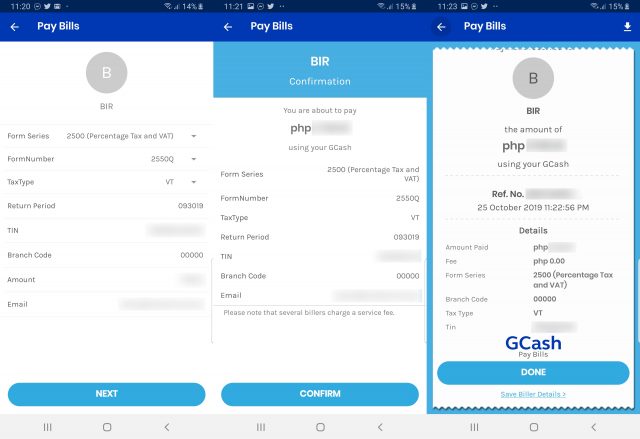

Step 10: Tap next and wait for the message

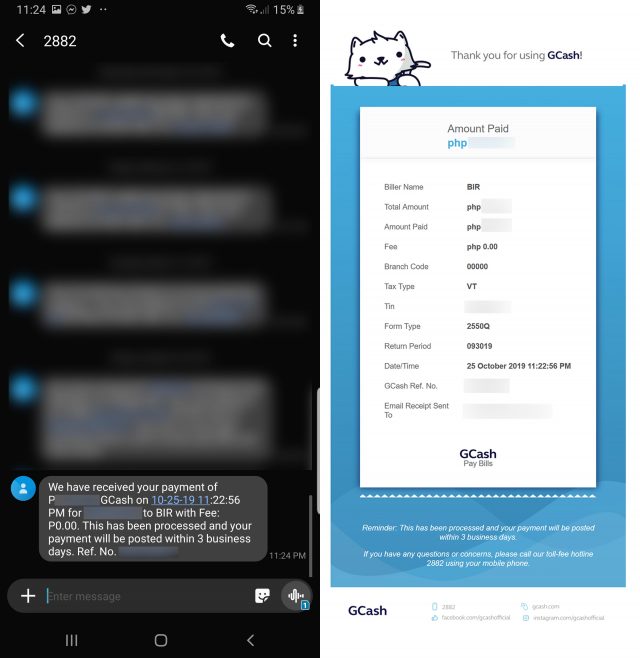

In this step, you will see an option of Next tap on it and now click on confirm. After your confirmation, you will receive an SMS that your amount has been deducted from your account and the BIR payment has been made.

After all these steps, you will efficiently and quickly pay your BIR bills and taxes through GCash. If you pay on weekends, your payment statement will be posted within 3 working days. Most amazingly GCash provides this service without any charge. To check it out, visit the BIR website and tap REVIE.

How to verify the TIN?

If you want to verify your TIN, you can ask the employee to check it through the ereg system. The second method is sending a mail to BIR and visiting RDO, and doing the verification. Another option is to download the TIN verifier mobile application, enter further details, and confirm your TIN number.

Conclusion:

Ultimately, this article provides you the information on BIR and GCash and How To Pay BIR Thru GCash. Now you can easily use GCash and clear your BIR payments monthly or annually. BIR and Gcash are very important for Filipinos, so they can easily access both by reading this article.

FAQs: How To Pay BIR Thru GCash

Q1: How To Pay By 0605 Using GCash?

Ans: if you have a good record of payments of GCash, then follow the following steps to pay BIR 0605 thru GCash:

1. Log into GCash

2. Select Biller category

3. Choose BIR.

4. Write your amount.

5. Enter your email address.

6. Tap next and confirm

Q2: How To Pay BIR Annual Registration Fee Thru GCash?

Ans: To pay the annual registration fee of BIR 0605, follow the steps mentioned below:

1. Log into the GCash account

2. Choose Pay billsTap on Government

3. Select BIR

4. Fill the requirements

5. Click Next

Q4: Can I Pay BIR Through GCash?

Ans: Yes, by following the steps mentioned in this article, you can quickly pay BIR via GCash.

Q5: How To Pay BIR Using GCash?

Ans: To pay BIR using GCash, you have to follow the following steps

Log into GCash

1. Select Biller category

2. Choose BIR.

3. Select your Form Series.

4. Enter your return period.

5. Input your TIN

6. Enter your branch code

7. Write your amount.

8. Enter your email address.

9. Tap next and confirm

10. Wait for the SMS

Q5: What Is The Branch Code in GCash?

Ans: The branch code is the number that comes after your 9-digit TIN. Suppose the TIN is 123-456-789-000, so 123456789 is your TIN, and 000 is the branch code.

Q6: Can I Get My TIN Verification Online?

Ans: Yes, you can do so, as BIR has introduced a mobile application to verify your TIN easily at your home without going to any office or counter.

Q7: What Is The BIR Registration Fee?

Ans: The business registration fee is PHP500 which will be paid yearly.

I’m Miguel Reyes, your trusted GCash expert here at Money Tech Guide. As a proud Filipino, I’m thrilled to share my extensive knowledge and firsthand experiences with GCash, the revolutionary digital payment platform that has transformed the way we handle our finances in the Philippines.