Learn how to pay Cashalo using GCash, in the Philippines. Follow simple steps to make your loan payments or settle your bills with Cashalo hassle-free using GCash.

With the rise of digital payment options, it can be tough to keep up with which platform to use for your transactions. One popular option in the Philippines is GCash, which allows users to pay bills, transfer money, and even shop online. If you’re considering using GCash to pay for your Cashalo loan, you’re in the right place. How to pay Cashalo using GCash?

Quick Overview on How To Pay Cashalo Using GCash:

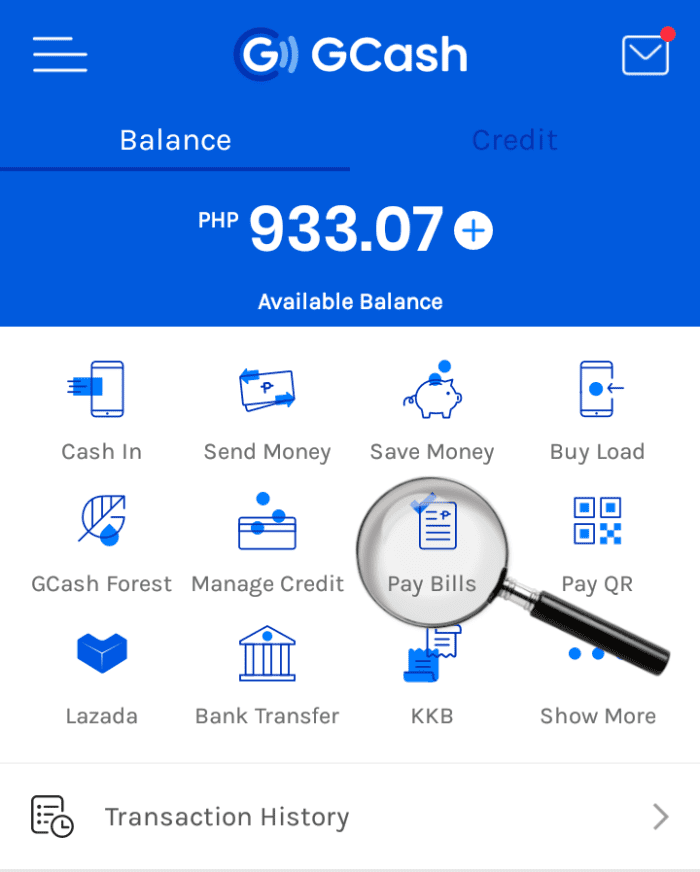

Step 1: Open your GCash app and log in to your account.

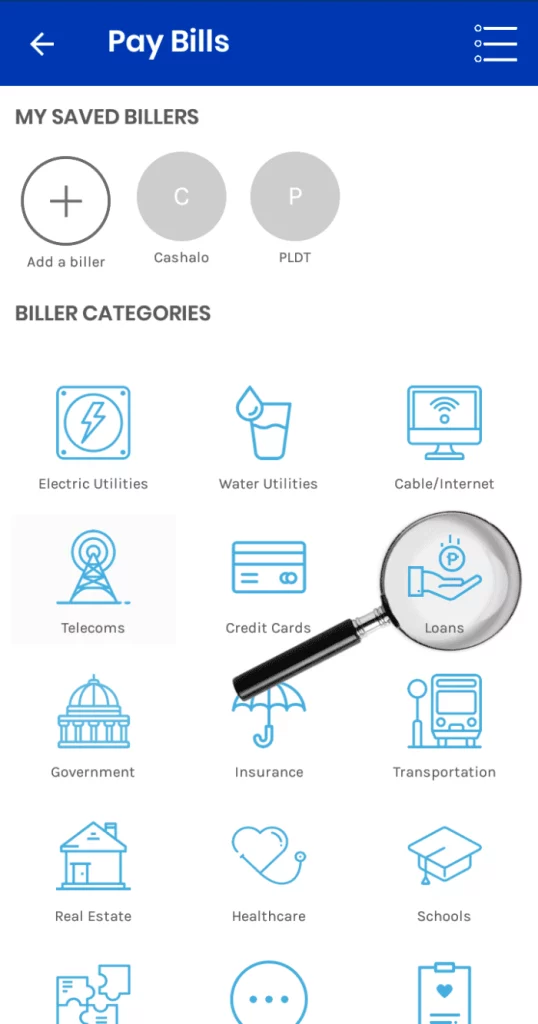

Step 2: Click on the “Pay Bills” icon on the main dashboard.

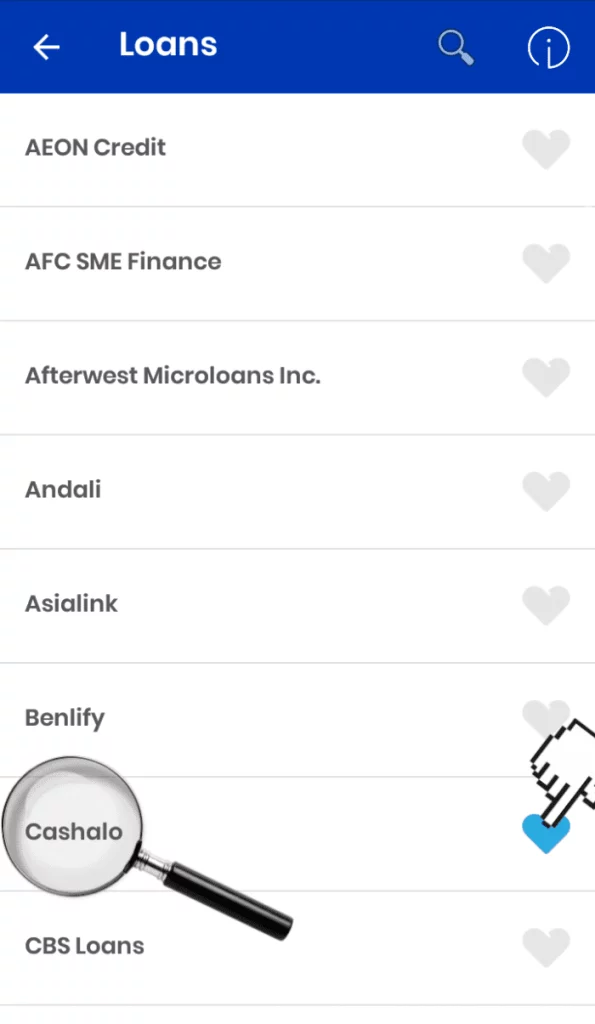

Step 3: Search for “Cashalo” in the list of billers.

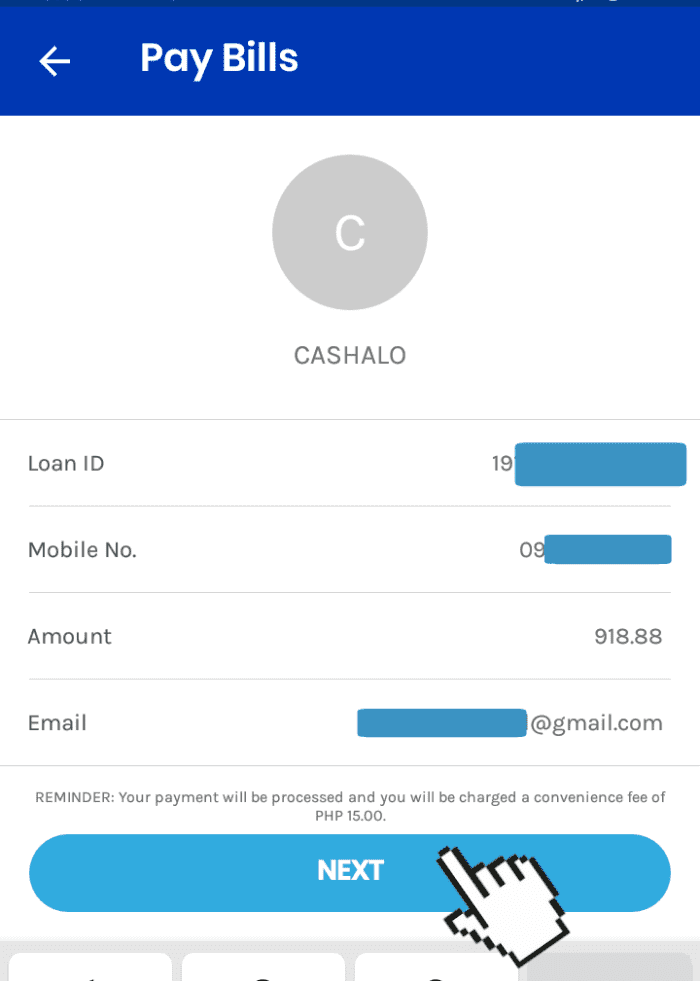

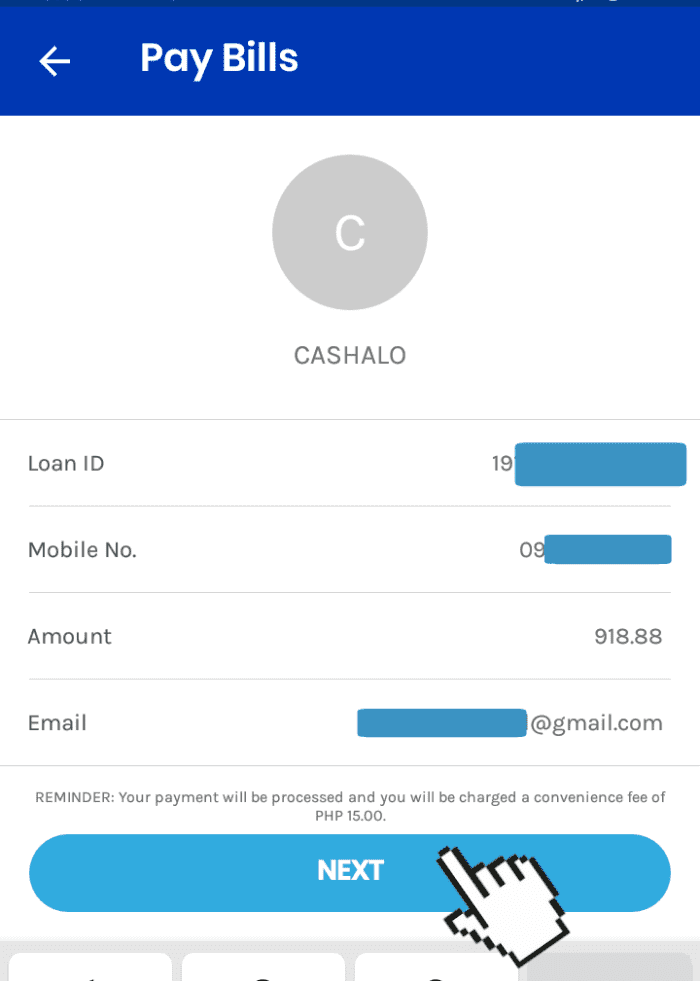

Step 4: Enter your Cashalo loan account number and the amount you want to pay.

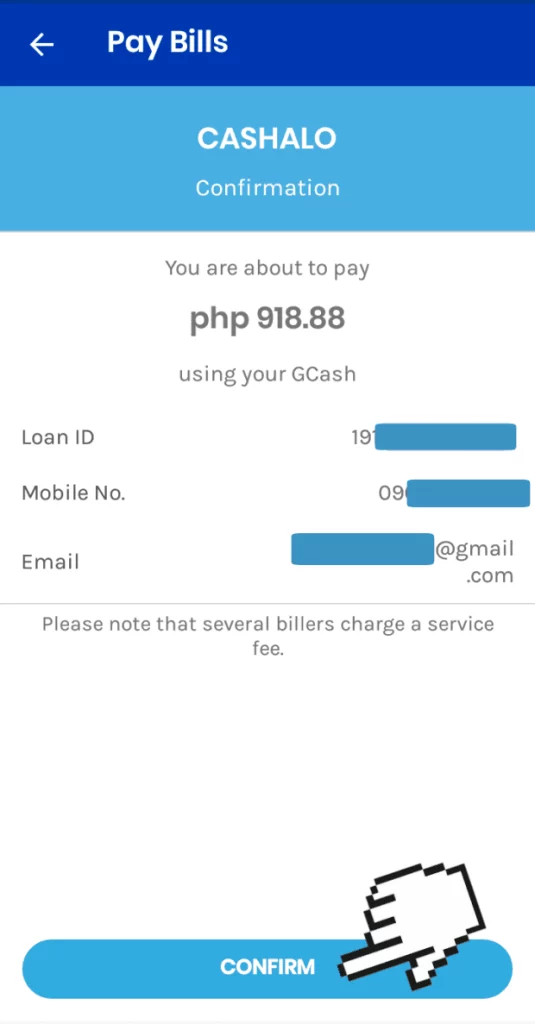

Step 5: Review the transaction details and click “Next”.

Step 6: Confirm the payment by entering your 4-digit MPIN.

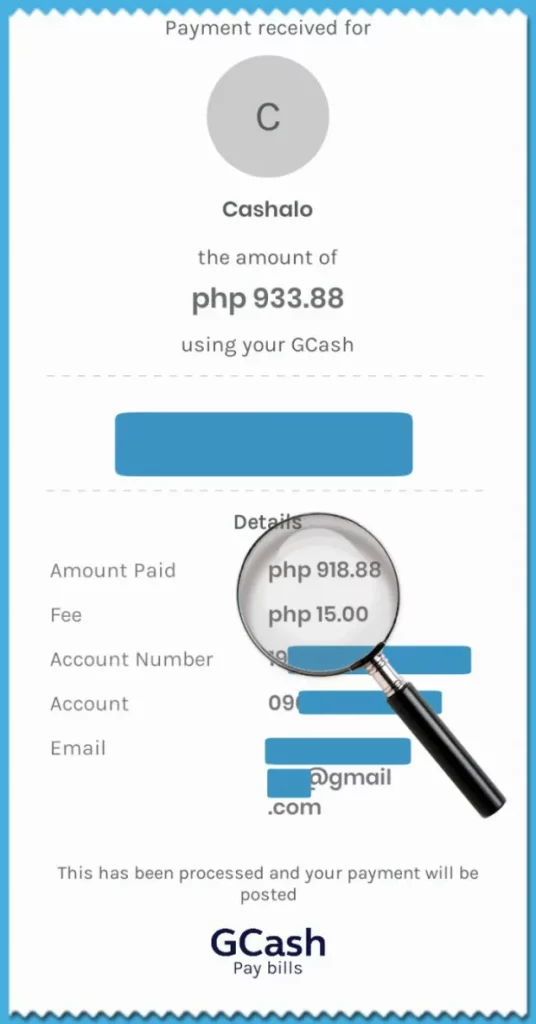

Step 7: Wait for the payment confirmation screen and take a screenshot of it.

Step 8: Submit the payment confirmation screenshot to Cashalo as proof of payment

Cashalo offers a wide range of loan products such as personal loans, salary loans, and small business loans. To avail of Cashalo’s services, you need to download the app from the App Store or Google Play Store and fill out an application form.

I understand that navigating new payment platforms can be daunting, but I promise to make it as easy as possible for you. So, let’s get started!

Linking Cashalo Loan Account to GCash

How to link Cashalo with GCash? Linking your Cashalo loan account to GCash is a simple process that can be done in a few easy steps.

It’s important to note that you need to have an active Cashalo loan account to be able to link it to your GCash account. If you haven’t yet applied for a Cashalo loan, you can do so easily through the Cashalo website or mobile app.

Once your loan is approved, you can then follow the steps above to link your account to GCash and enjoy the convenience of managing your loan repayments through the GCash app.

How To Pay Cashalo Using GCash?

If you have taken out a loan with Cashalo and you want to make your payment using GCash, it’s a straightforward process. Here are the step-by-step instructions to help you pay your Cashalo payment using GCash:

Step 1: Open your GCash app and log in to your account.

Step 2: Click on the “Pay Bills” icon on the main dashboard

Step 3: Search for “Cashalo” in the list of billers

Step 4: Enter your Cashalo loan account number and the amount you want to pay

Step 5: Review the transaction details and click “Next.”

Step 6: Confirm the payment by entering your 4-digit MPIN

Step 7: Wait for the payment confirmation screen and take a screenshot of it

Step 8: Submit the payment confirmation screenshot to Cashalo as proof of payment

That’s it! With these simple steps, you can easily pay your Cashalo loan using GCash. It’s a fast and secure way to make your payments, and you can do it from the comfort of your own home.

Troubleshooting Common Issues with Paying Cashalo Using GCash

While paying Cashalo through GCash app is a convenient option, it may not always go smoothly. If you encounter any issues, don’t worry because there are simple solutions to common problems.

- One common issue is the mismatch of the name on your Cashalo account and your GCash account. If you encounter this issue, you will need to contact Cashalo’s customer service to update your details on their system.

- Another issue is when the payment is not reflected on your Cashalo account. In this case, you need to check if the payment has been debited from your GCash account. If the payment has been debited, contact Cashalo’s customer service to have them update your account status.

- If you encounter any technical issues, like a slow internet connection or app glitch, it’s best to try again later or restart your device. If the problem persists, you can contact GCash’s customer service for assistance.

- Remember that paying Cashalo using GCash is a convenient and fast option, but it’s always good to be prepared for any issues that may arise. By following these troubleshooting tips, you can quickly resolve any issues and continue using this hassle-free payment option.

Conclusion

How to pay Cashalo using GCash? Paying your Cashalo loans using GCash is an easy and convenient option. By following the step-by-step guide provided, you can easily make your payment without leaving the comfort of your own home or office. Furthermore, always make sure that you have enough funds in your GCash account to avoid any complications or delays in your payment.

I hope you found this guide informative and useful. Don’t hesitate to reach out if you have any questions or concerns, and happy shopping!

FAQ’s

What Happens If You Don’t Pay Cashalo?

If you miss a payment or pay late, Cashalo may charge you a late payment fee. If you do not pay your loan on time, Cashalo may contact you to remind you to pay. If you continue to miss payments, they may escalate their efforts to collect the debt. If you do not pay your loan on time, Cashalo may report the delinquency to credit bureaus, which can negatively impact your credit score. If you continue to ignore payment requests, Cashalo may take legal action against you to recover the amount owed.

Where Can I Pay Cashalo?

You can visit any of the Cashalo payment partners such as Bayad Center, 7-Eleven, Cebuana Lhuillier, M Lhuillier, SM Payment Counters, Robinsons Department Stores, and more. You can also pay your Cashalo loan online through the following channels: GCash, PayMaya, and DragonPay. Log in to your account and follow the prompts to complete the payment. You can also pay your Cashalo loan through bank transfer. You can enroll in an auto-debit arrangement where the payment is automatically deducted from your bank account on the due date.

Can I Pay Cashalo In Installments?

When you apply for a loan through Cashalo, the terms of repayment will be outlined in the loan agreement. This will include the loan amount, interest rate, and repayment schedule, which may be weekly or monthly, depending on the loan product. If the loan agreement specifies that you can repay the loan in installments, you will be required to make regular payments according to the agreed-upon schedule until the loan is fully paid off.

How Much Is The Minimum Loan For Cashalo?

Cashalo is a Philippine-based digital lending platform that offers loans ranging from PHP 2,000 to PHP 10,000, depending on the borrower’s creditworthiness and other factors. It’s always best to check with Cashalo directly or refer to their website for the latest information on their minimum loan amounts and other lending requirements.

Is Cashalo Safe?

Cashalo has implemented various security measures to protect its customers’ information and transactions, such as using encryption technology and regularly updating its systems to prevent unauthorized access or fraud. Cashalo also has a customer service team available to address any concerns or issues that customers may have.

I’m Miguel Reyes, your trusted GCash expert here at Money Tech Guide. As a proud Filipino, I’m thrilled to share my extensive knowledge and firsthand experiences with GCash, the revolutionary digital payment platform that has transformed the way we handle our finances in the Philippines.