Learn how to pay Converge using GCash with a step-by-step guide. Find out how to send and receive money to Converge through GCash, and troubleshooting tips to help resolve them.

In today’s digital age, online transactions continue to gain popularity as more people opt for the convenience and security of online payments. As such, there is a growing demand for reliable and efficient online payment platforms. One such platform that has gained popularity over the years is GCash. How to pay converge using GCash?

Quick Overview on How to Pay Converge Using GCash:

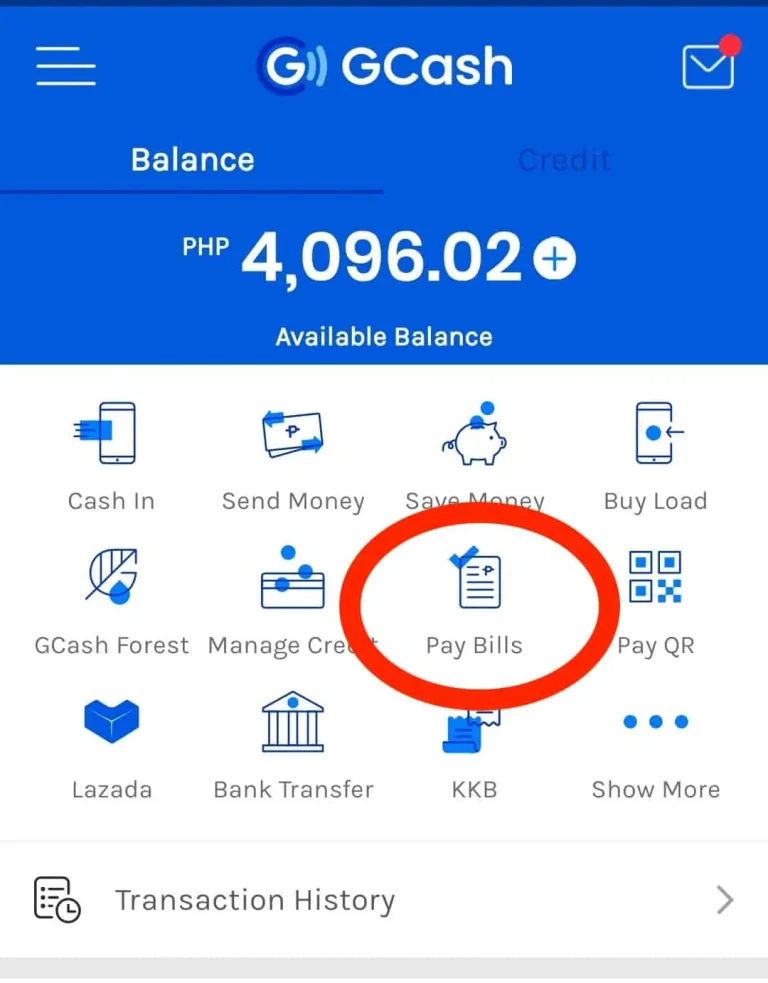

Step 1: Open your GCash app and log in to your account.

Step 2: From the home screen, tap on “Pay Bills.”

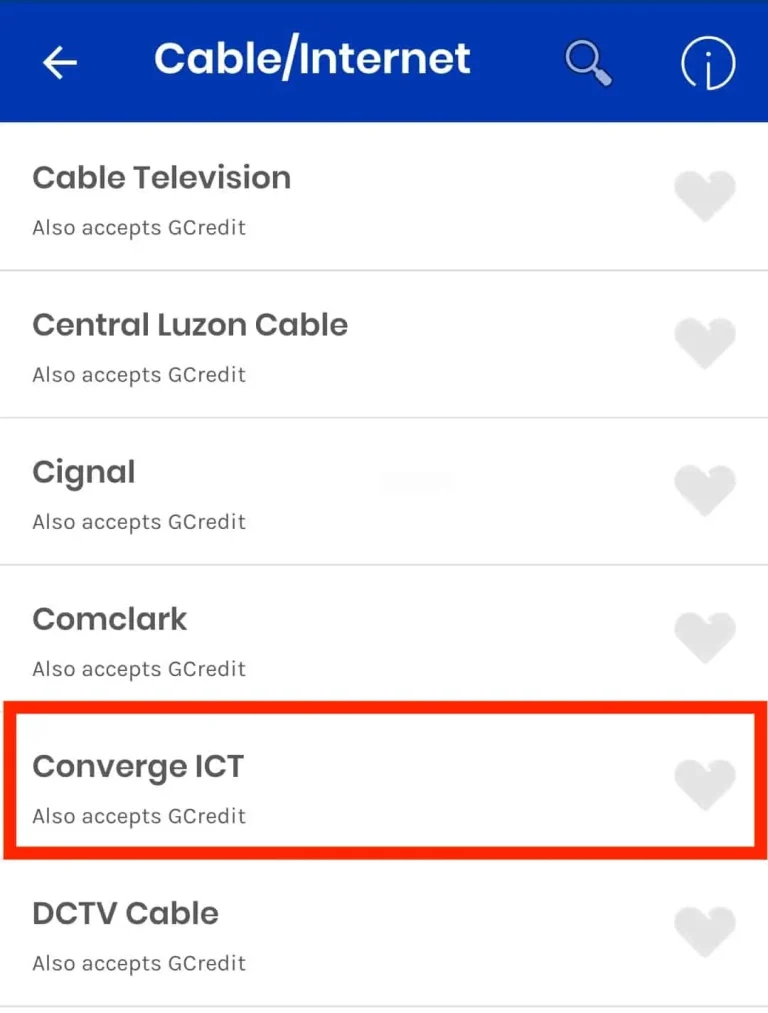

Step 3: Search for “Converge” on the list of billers.

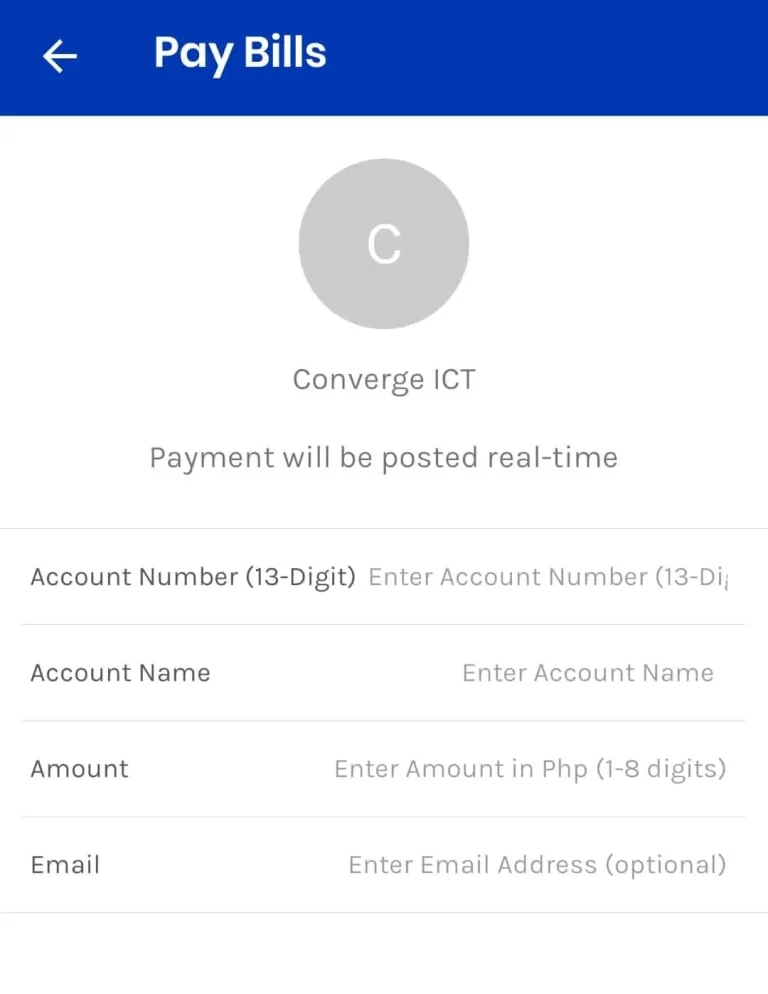

Step 4: Enter your Converge account number and the amount you wish to pay.

Step 5: Review the payment details and confirm the transaction.

Step 6: Wait for the payment confirmation to appear on your GCash app.

Simply open the GCash app, select “Pay Bills,” and choose Converge as the biller. Enter the amount you wish to pay and your Converge account number, review the details, and tap “Confirm.” The payment will be processed instantly, and you’ll receive a confirmation message. With GCash, you can conveniently manage your Converge bill payments from your mobile device, no matter where you are.

So if you want to learn more about GCash and how it can help you with your online transactions, read on!

How to Pay Converge Using GCash?

To pay Converge using GCash payment, you can follow these steps:

- Open your GCash app and log in to your account.

- From the home screen, tap on “Pay Bills.”

- Search for “Converge” on the list of billers.

- Enter your Converge account number and the amount you wish to pay.

- Review the payment details and confirm the transaction.

- Wait for the payment confirmation to appear on your GCash app.

Alternatively, you can also use the “Scan QR” option on your GCash app to scan the QR code found on your Converge bill. This will automatically fill in the payment details, and you can proceed with the payment confirmation.

Setting up a GCash account and linking it to your bank account

To start to Converge payments using GCash, the first step is to set up a GCash account and link it to your bank account. This is a quick and easy process that can be done through the GCash app.

- First, download the GCash app from the App Store or Google Play Store and register for an account. You will be asked to provide some personal information and create a four-digit MPIN for added security. Once you have registered, you can start linking your bank account to your GCash account.

- To do this, select the ‘Bank Transfer’ option on the app’s main menu and then select the bank you want to link to your GCash account. Follow the prompts to enter your bank account details and verify your account through the app. You may also be asked to provide a valid ID for added security.

- Once your bank account is linked to your GCash account, you can start using GCash for all your internet payments. You can easily transfer funds from your bank account to your GCash wallet and then use the funds to pay for online purchases, bills, and other transactions.

With GCash, you can enjoy a seamless and secure payment experience that’s both convenient and hassle-free.

How to Use GCash to Pay for Online Purchases?

GCash is a popular mobile wallet in the Philippines that allows you to pay for your online purchases with ease. Here’s a step-by-step guide on how to use GCash to pay for your online purchases:

1: Load up your GCash account

Before you can start using GCash to pay for your online purchases, you need to load up your account with funds. You can do this by linking your bank account or by going to a GCash partner outlet and depositing cash.

2: Look for online merchants that accept GCash payments

Not all online merchants accept GCash as a form of payment, so make sure you check if they do it before making a purchase. You can find this information on their website or by contacting their customer service.

3: Select GCash as your payment option during checkout

Once you’ve chosen the items you want to purchase and you’re ready to checkout, select GCash as your payment option. You’ll be redirected to the GCash app or website to complete the payment process.

4: Confirm the payment details

Before finalizing your payment, make sure to review the payment details to ensure that everything is correct. This includes the amount to be paid, the merchant’s details, and the transaction details.

5: Enter the One-Time Pin (OTP) sent to your mobile number

After confirming the payment details, an OTP will be sent to your mobile number. Enter this code on the GCash app or website to complete the payment process.

6: Wait for the confirmation message

Once the payment has been processed, wait for the confirmation message from GCash and the online merchant. You’ll also receive an email receipt for your records.

Using GCash to pay for your online purchases is a simple and convenient way to shop online. By following these steps, you can enjoy a hassle-free shopping experience and have peace of mind knowing that your transactions are secure.

How to Send and Receive Money to Converge through Gcash

Sending and receiving money through GCash to pay your Converge bill is a quick and easy process. Here are the steps to follow:

To Send Money to Converge:

- Open the GCash app on your mobile device and log in.

- Tap on the “Send Money” icon from the home screen.

- Enter the amount you wish to send and select “Express Send”.

- Enter the mobile number associated with your Converge account in the recipient field.

- Review the details of your transaction and tap “Send” to complete the transaction.

- You will receive a confirmation message once the transaction is completed.

To Receive Money from Converge:

- Open the GCash app on your mobile device and log in.

- Tap on the “Cash-in” icon from the home screen.

- Select “Remittance” and choose the remittance center where the money was sent from.

- Enter the reference number provided by Converge and the amount received.

- Review the details of the transaction and tap “Confirm” to complete the transaction.

- The money will be credited to your GCash wallet balance and can be used to pay your Converge bill or for other transactions.

It is essential to ensure that you have sufficient funds in your GCash wallet to complete the transaction. Also, make sure to input the correct recipient or reference number to avoid delays or errors in the transaction.

Conclusion

I hope you found this ultimate guide on how to pay Converge using GCash helpful. In today’s digital age, it’s important to have access to secure and convenient payment methods. With GCash, you can easily pay your Converge internet bill with just a few clicks. Our guide covered everything you need to know to get started, from setting up your GCash account to paying your Converge bill.

I hope this guide has made your life a little bit easier, and I look forward to providing you with more valuable insights and helpful tips in the future. Thank you!

To learn more about online payments via GCash visit Money Tech Guide.

FAQ’s | How to Pay Converge Using GCash

Can I Pay Converge Using GCash After The Due Date?

While it’s possible to pay your Converge bill using GCash after the due date, it’s important to note that you may incur late payment fees or penalties. Converge’s billing policies may vary, so it’s best to check with their customer service for any applicable fees or penalties. However, paying your Converge bill on time or before the due date is highly recommended to avoid any late payment charges and ensure uninterrupted service.

How Do I Pay My Converge Bill Online?

Firstly, go to Converge’s official website and log in to your account. Next, select “Pay My Bill” and choose your preferred payment method, which may include credit or debit card, online bank transfer, or e-wallets such as GCash or PayMaya. Enter the amount you wish to pay and review the payment details before submitting the payment. Once the payment is processed, you’ll receive a confirmation message.

How Can I Pay Using GCash?

To pay using GCash, open the GCash app and select “Pay Bills” or “Scan QR Code.” Choose the biller you wish to pay, enter the amount to be paid, and review the details before confirming the transaction.

How Do I Pay To Converge Prepaid?

Firstly, make sure that your Converge Prepaid account is active and has a sufficient credit balance. Next, open the GCash app and select “Buy Load.” Choose “Converge ICT Prepaid” as the network provider and enter the mobile number associated with your Converge Prepaid account. Enter the amount you wish to load and confirm the transaction. You’ll receive a confirmation message once the payment has been processed, and your Converge Prepaid account will be credited with the corresponding load balance.

How Many Days Before Converge Disconnection?

Converge’s disconnection policy may vary depending on the type of service plan and the terms and conditions of the contract. However, in general, Converge usually provides a grace period of 30 days after the due date for payment.

How Much Is The Penalty For Converge’s late Payment?

The penalty for late payment with Converge will depend on the specific terms of your contract with them and the amount of time that has passed since the due date. Typically, Converge charges a late fee for payments that are not received by the due date, which can be 1.5 percent of the outstanding balance to a fixed amount.

I’m Miguel Reyes, your trusted GCash expert here at Money Tech Guide. As a proud Filipino, I’m thrilled to share my extensive knowledge and firsthand experiences with GCash, the revolutionary digital payment platform that has transformed the way we handle our finances in the Philippines.